As promised on my previous blog, here’s my full take on the Advanced Notice of Proposed Rulemaking (ANPRM) (which is essentially a PRE-proposed rule) for CMS’ proposed International Pricing Index (IPI) Model.

The Trump administration is claiming that the IPI Model will help to curb the skyrocketing health care costs. On the contrary, there seems to be a consensus among manufacturers and providers that although health care costs are skyrocketing, targeting Medicare Part B drugs in the proposed manner will actually INCREASE overall health care costs and DECREASE quality of care.

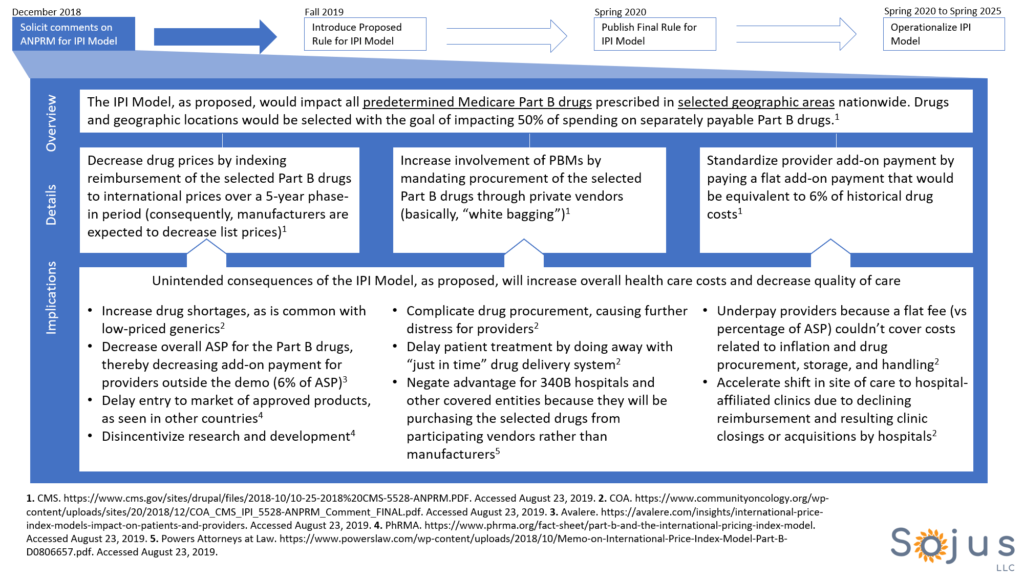

Here’s the proposed IPI Model in a nutshell:

- The IPI Model would impact selected drugs that are administered by providers in the outpatient setting (clinics and hospital outpatient departments) IF they are prescribed within predetermined locations

- The ANPRM hasn’t specified which drugs or which geographic locations would be impacted. Nonetheless, the impact would be significant as it would cover 50% of Part B drug claims (wow!)

- The ANPRM states that radiopharmaceuticals and certain ESRD drugs would be excluded from the IPI Model

- CMS would set the Medicare payment amount for the selected Part B drugs to closely align with international prices

- Private vendors would be allowed to negotiate prices for drugs, take title to drugs, and compete for physician and hospital business (essentially, the drugs would have to be “white bagged”)

- Physicians would be reimbursed a FLAT add-on payment for administering these selected Part B drugs (instead of ASP plus 4.3%)

I studied the publicly available comment letters submitted in response to this ANPRM in order to learn about the implications of the proposed IPI Model. Here are my two main takeaways:

- Manufacturers and providers BOTH agree that decreasing the list prices and increasing PBM involvement will actually increase overall health care cost and decrease quality of care

- A sound alternative to the currently proposed provisions of the IPI Model is a value-based care initiative. I think that’s an excellent way for providers, manufacturers, and payers to meet half-way–though implementation of such innovative payment systems is new and therefore has its own challenges.

Below is a visual summary of the proposed IPI model and its implications.

Now that you know about the proposed provisions of the IPI Model, what now? Well, it’s not too late. Its important to put up a fight against the IPI Model for 2 reasons:

- The IPI Model, if finalized, would serve as a hook for President Trump’s campaign to counter the Democratic opponents who are intently discussing their own proposed health care reforms. Since the IPI Model is based on the assumption that high health care costs are due to high drug prices, manufacturers would become scapegoats for President Trump’s 2020 campaign

- If your drug happens to be targeted by the IPI Model, then you will have to lower your list price to the international pricing index (ouch!)

When the proposed rule for the IPI Model is released, make your voice be heard. Another strategy is to partner with provider organizations (such as COA and AMA) to double the strength of your team.

It’s time to make big strides and turn heads–let’s go.